Without Assistance

By Connor Zimmerlee

Reporting Texas

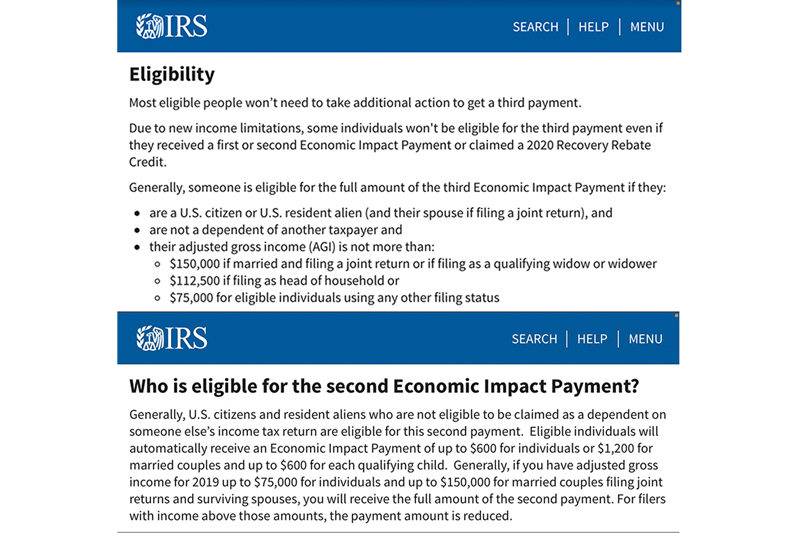

For millions of Americans, the most recent stimulus checks they received offered temporary financial reprieve in the middle of an unprecedented pandemic. As part of the $1.9 trillion stimulus package, eligible adults received checks for $1,400 to help with rent, groceries, bills and other essentials.

A group impacted by these stimulus checks, or missing out, have been college students across the country. That is true for Haley Capps, a senior at The University of Texas at Austin, who was ineligible for all three stimulus checks.

UT student Haley Capps perspective. Audio by Alyssa Quiles.

“I was not eligible to receive any of the stimulus money since I don’t make enough money at my job to file as independent and my parents claim me as a dependent,” Capps said. “I could have really used the money to help keep me afloat last year.”

While some students received their checks, whether it was all three or just the last one, students like Haley were forced to increase their hours at work just to be able to maintain a semblance of stability.

“I was working up to 40 hours a week during the height of the pandemic so I wouldn’t get furloughed and lose my only source of income,” Capps said. “If I had gotten any of the three checks, I could have worked significantly less hours and managed to stay afloat.”

More from Haley Capps. Audio by Alyssa Quiles.

Capps, a part-time employee, saw her weekly hours double to 40 or more hours a week at the height of the pandemic. Not only was she working 80 or more hours during her two week pay periods in order to make enough money for rent. Her grades suffered.

“I was working so many hours that I would work during scheduled class times,” Capps said. “I would then go back and watch the recorded zoom lectures and basically had to self-teach myself on top of working as much as I did.”

For many college students, it is already a difficult time to multitask a part-time job, sometimes multiple jobs, and keep up a heavy course load. Without any assistance from the government, and often no help from their parents either, students were left alone to figure out how to survive financially in the middle of a global pandemic.

Samantha Maksud, a senior at Baylor University, experienced this struggle for herself first hand as she figured out to how manage during the height of COVID. Because she works with Baylor’s football team, health protocols impacting athletics erased much of her income.

“Due to the pandemic, I was unable to work or have access to my work as often as I used to,” Maksud said. “My hours were basically cut down to zero as a result of COVID.”

UT student Samantha Maksud perspective. Audio by Alyssa Quiles.

Where Haley was working sometimes over 40 hours a week just to make ends meet, on the opposite end of the spectrum there are students like Samantha unable to work at all and had to find alternative income.

“Honestly, last year was the worst I have ever been mentally,” Maksud said. “There were times when I had to ask myself what meals I could skip in order to make food last longer, since I couldn’t get groceries as often as I needed to.”

Trapped in a no-win situation of not earning enough to receive government relief or work cut short by health protocols and shuttered campuses, Capps’ and Maksud’s experience reflect students’ pandemic economics.