Hundreds Rally to Protest ‘Tampon Tax’

By Mary McFadden

Reporting Texas

A wave of mostly women dressed in red descended on Republic Square in downtown Austin on a recent Saturday to protest a tax on period paraphernalia as part of a nationwide “menstrual movement.”

The National Period Day Rally was organized by Period.org, a non-profit with the goal to reduce the stigma around menstruation and period poverty through “service, education, and advocacy.” About 200 people gathered in Austin in October to “elevate the issue of period poverty and demand real change to making period products more accessible for all and ending the Tampon Tax” according to their Facebook event.

The tampon tax is a colloquial term for the fact that female hygiene products such as tampons and sanitary napkins do not receive the same tax exemptions as other necessities like groceries and prescription medicine.

“The tampon tax should be removed in Texas for the simple reason that needing pads and tampons alike is not a luxury or an act of indulgence but rather a necessity to maintaining a certain quality of life,” said Alexzandra Roman, president of the University of Texas chapter of the Women’s Resource Agency.

The WRA was an active participant of the Period Rally this month, even hosting an event beforehand called #EndPeriodPoverty to make signs for the rally and discuss issues surrounding menstruation.

There isn’t an actual “tampon tax”, meaning that there isn’t a specific tax on feminine hygiene products. Rather, these products are excluded from “necessity” status which, in turn, puts them in the “luxury” category. This binary language makes it easy for those who protest the tax- as anyone can agree that menstrual products are anything but luxurious.

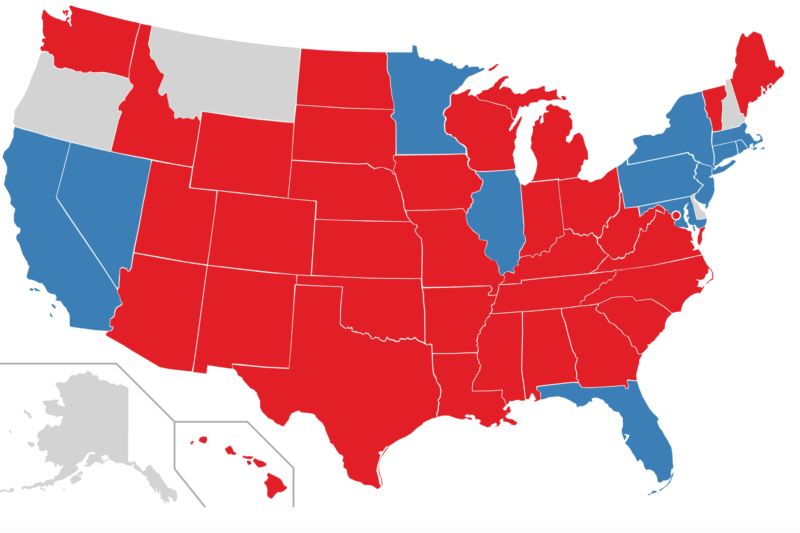

Feminine products are currently taxed in 35 states in America. Five states are exempt from the debate since they don’t have sales tax at all- Alaska, Montana, Delaware, New Hampshire, and Oregon. In the past three years, five states have removed the tax- Illinois, Nevada, New York, Connecticut and Florida. Twenty-two states, including Texas, introduced bills to eliminate the tax this year, but the bills were not successful.

Source: Joe Roe

It could be easy to imagine critics of repealing the tampon tax as old misogynists in suits, but that’s not the case. Most who vote against the tax cut would probably vote against a tax cut of any kind. In her paper “Tampon Taxes: Do Feminine Hygiene Products Deserve a Sales Tax Exemption?” Nicole Kaeding, an economist with the Tax Foundation, argues that exempting feminine hygiene products from taxation is not in the country’s best interest.

“Exempting feminine hygiene products from the sales tax base results in less revenue for the state, leading to higher overall rates in the long run,” Kaeding said.

It’s not that feminine hygiene products aren’t necessary, rather Kaeding says that an “ideal sales tax should apply to all final consumer purchases, without regard to whether items are classified as ‘necessities’ or ‘luxuries.’” Exempting these items, Kaeding added, would contribute to a “broader trend of shrinking state sales tax bases” which, in the long run, will result in higher taxes in other places.

Those who argue on behalf of eliminating the tampon tax say that, regardless of how elimination would affect governmental budget, the tax should be removed all the same.

Advocates argue that taxing an item necessary for half the population is discriminatory. The common phrase used in the debate is, “Why are tampons taxed when Viagra isn’t?”

“This necessity for life is something we see used to justify why products such as Viagra and Rogaine are sold without a sales tax,” Roman, of the Women’s Resource Agency, said . “If this is the case then menstruators are just being taxed for the natural function of their body menstruating and nothing about that is fair or equal.”